Car Loans Rate Of Interest

Even if your credit score is lower you may still qualify for.

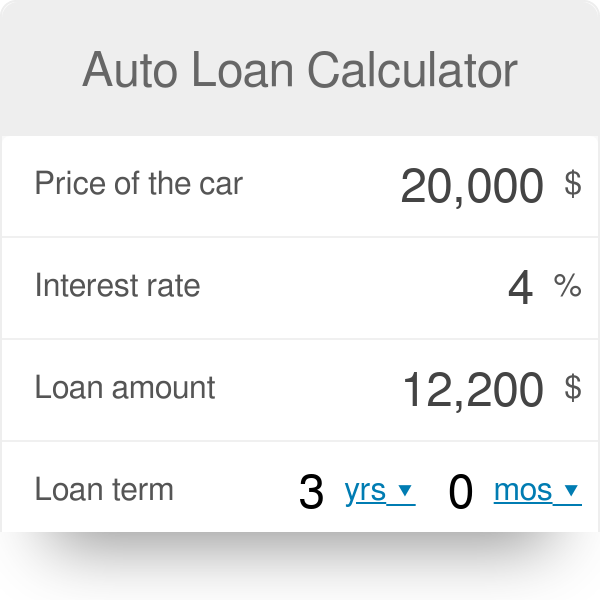

Car loans rate of interest. In malaysia most car loans are the fixed rate variant. See some of the lowest comparison rate 5 star rated car loan products on canstars database. The average buyer can expect to pay anywhere between 45 to 6 interest on their car loan depending on whether the car is new or used and whether the interest rate is fixed or variable. Canstars highest rated used car loans with the lowest comparison rates.

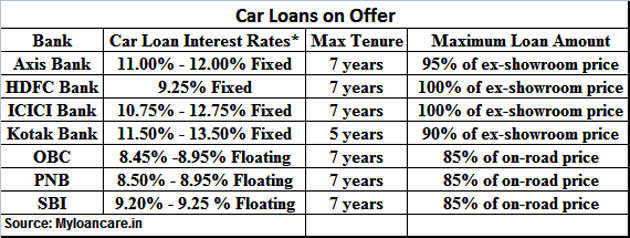

Find all banks latest car loan interest rates. Compare and calculate your monthly repayments on loanstreets car loan calculator and save more than rm100 every month. At 1099 the average new car interest rate we found for people with poor credit the total interest comes to 8762. See all 2020 eofy deals.

The interest rate will apply on the loan amount from the time that you take out the loan. Compare best car loan interest rates in india for 2020. Find a competitive interest rate for your hire purchase from 18 banks in malaysia. Shopping for a car loan for your new or used car.

Compare car loans in malaysia 2020. Credit scores of 719 for a new car or 655 for a used car or higher will help you qualify for the lowest auto loan interest rates. You can take the loan for 90 to 100 of the on road price of the car. Using a car loan calculator in malaysia to find the best.

Interest rates vary between 5 and 10 for secured car loans and up to 15 for unsecured loans. What you should know about the advertised low interest rate on car loans. Thats nearly a quarter of the cars purchase price of 36000 and about 5000 in added costs compared to what someone with excellent credit would pay. The following example shows the amount of interest you could end up paying for a brand new 36000 car assuming a loan term of 7 years and a down payment of 3600.

Car loan with interest rates as low as 770 pa. Just because you see a low interest rate advertised for a car loan with one particular lender. When you take out a car loan you need to repay the lump sum you borrowed the principal as well as interest on the car loan.